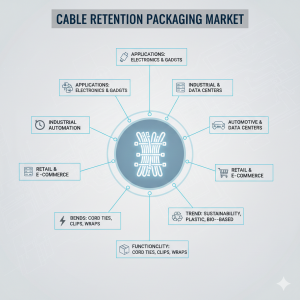

Cable Retention Packaging Market to Reach USD 2.2 Billion by 2036, Surging at 13.9% CAGR as Tech Giants Purge Plastics

Cable retention packaging market is set to record a valuation of USD 0.6 billion in 2026, advancing toward USD 2.2 billion by 2036, at a 13.9% CAGR.

NEWARK, DE, UNITED STATES, February 6, 2026 /EINPresswire.com/ -- The global cable retention packaging market is entering a decade of high-velocity transformation. According to a new strategic analysis by Future Market Insights (FMI), the sector is projected to scale from a valuation of USD 0.6 billion in 2026 to a staggering USD 2.2 billion by 2036. This growth, representing a 13.9% CAGR, marks a fundamental shift in how the world’s most pervasive electronics components are secured, shipped, and presented to consumers.

The trajectory is being redefined by two converging forces: a categorical pivot by major Tech OEMs toward plastic-free "unboxing" and the operational urgency of high-speed e-commerce fulfillment.

Regulatory Mandates: The Death of the Plastic Twist-Tie

A primary catalyst for this design overhaul is the European Union’s Packaging and Packaging Waste Regulation (PPWR), which takes full effect on August 12, 2026. The regulation mandates strict "void space" caps and enforces a limit of 100 mg/kg for heavy metals in packaging.

These mandates have effectively rendered traditional PVC-based twist ties and bulky plastic trays obsolete. "The industry is moving from a 'design plus sustainability' narrative to 'prove-it' compliance," notes the FMI report. Consequently, engineers are aggressively adopting fiber-based locking mechanisms and repulpable paper ties that seamlessly integrate into existing recycling streams.

Request For Sample Report | Customize Report | Purchase Full Report

https://www.futuremarketinsights.com/reports/sample/rep-gb-31864

Consumer Electronics: The Dominant 46% Market Anchor

The consumer electronics segment currently commands 46% of the market, a share anchored by tech giants like Apple and Sony.

• Apple’s Material Decoupling: Having released multiple product lines, including the iPhone 15 and Apple Watch, with over 95% fiber-based packaging, Apple has effectively standardized the supply chain around cellulose-based accessories.

• Sony’s "Road to Zero": Sony has targeted the total elimination of plastic from newly designed small product packaging, including the complete removal of charging cables from select smartphone boxes to reduce volume and waste.

Market Highlights: Key Metrics (2026–2036)

• Market Value (2026E): USD 0.6 Billion

• Projected Value (2036F): USD 2.2 Billion

• CAGR (2026-2036): 13.9%

• Dominant Segment: Consumer Electronics (46% Share)

• Fastest Growing Region: China (14.8% CAGR)

E-Commerce and Logistics: Performance Under Pressure

Beyond sustainability, the market is being shaped by the "last mile" reality. With e-commerce revenue in the U.S. consumer electronics sector forecasted to increase by 53.8% by 2025, packaging must survive automated sorting while minimizing manual assembly time.

Innovation is centering on "intelligent retention" solutions, such as Sealed Air’s Korrvu Rapid Fix, which utilizes high-resilience, low-slip film to lock cables in place in seconds. These systems reduce manual bottlenecks in fulfillment centers while offering superior shock and vibration protection compared to traditional loose-fill methods.

Regional Outlook: China and USA Lead the Charge

• China (14.8% CAGR): As the world’s electronics assembly hub, China is rapidly adopting carded retention packs to satisfy "green entry" requirements for Western markets. In June 2024 alone, China exported 240,000 metric tons of wire and cable, a 19.3% year-on-year increase, driving massive demand for compliant export packaging.

• United States (12.6% CAGR): Driven by an e-commerce market that reached $487 billion in retail revenue by 2023, U.S. brands are prioritizing curb-side recyclability and logistical "cube efficiency."

• Germany (11.4% CAGR): Focusing on industrial precision, German firms are replacing single-use plastic straps with robust, heavy-duty paper-based alternatives for industrial cable management.

Competitive Landscape: M&A and Strategic Integration

The industry is witnessing rapid consolidation as players race to secure sustainable material streams. In late 2025, Sealed Air Corporation agreed to a $10.3 billion acquisition by funds affiliated with CD&R to accelerate its sustainable technology pipeline. Similarly, Amcor’s merger with Berry Global and Mondi Group’s acquisition of Schumacher Packaging underscore a move toward vertically integrated, fiber-centric solutions.

"We are no longer merely adhering to norms; we are establishing a higher standard for safety and circularity," says Alex Necovski, Head of Nordics Europe Region at Nefab.

Outlook

The cable retention packaging market has evolved from a passive component to an active participant in the IoT-enabled supply chain. For senior decision-makers, the message is clear: the ability to deliver plastic-free, high-performance retention solutions is now the primary determinant of global supplier selection.

Similar Industry Reports

Suspension & Retention Packaging Market

https://www.futuremarketinsights.com/reports/suspension-and-retention-packaging-market

Packaging Testing Services Market

https://www.futuremarketinsights.com/reports/packaging-testing-services-market

Cable Maintenance Services Market

https://www.futuremarketinsights.com/reports/cable-maintenance-services-market

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.